你欠你5美元吗.50亿和解?

If you or your business accepted Visa or Mastercard credit cards as payment between January 1, 2004年及1月25日, 2019, 你可能有权得到...

This article was updated with new information on 2020年3月20日 at 8:45 a.m. Also, you can see an FAQ about the Act by 点击这里.

周三, 3月18日, 2020, 在参议院通过几小时后, the President signed legislation providing relief to those impacted by the Coronavirus. 该法案提倡带薪病假, increased food and unemployment benefits as well as other provisions. Some of the key provisions of the bill are highlighted below. Additional relief is expected in the coming days following the recently released Notice 2020-17 providing for the deferral of certain tax payments previously due April 15, 2020年至7月15日, 2020.

If you have questions about the Families First Act, you can email familiesfirstact@ladies-wine.com

4月2日生效nd, in addition to the pay required under the expanded FMLA (see below), employers with less than 500 employees are required to provide 80 hours of paid leave for full time employees and the average number of hours worked over a 2 week period for part time employees for the following situations:

For employees qualifying under condition 1, 2 or 3 above the required paid sick time is their normal pay up to $511 per day for 10 days. For employees qualifying under condition 4, 5 or 6 above, the required paid sick time is 2/3rd of their regular pay up to $200 per day for 10 days.

Employers shall be entitled to a credit against payroll taxes equal to 100% of qualified sick leave paid by such employer, 限于实际支付的金额.

The overall limitation on the number of days taken into account under the above paragraph for any quarter shall not exceed the excess of 10 over the aggregate number of days taken into account for all preceding calendar quarters.

The Family and Medical Leave Act of 1993 is amended to include language expanding relief to to those with a qualifying need as a result of a public health emergency. A qualifying need is described as a leave where the employee is unable to work (or telework) due to a need to care for a son or daughter under 18 years of age as a result of the closure of school or place of child care as a result of 新型冠状病毒肺炎. The expansion applies as of April 2nd to employers with fewer than 500 employees and requires the following for those with a qualifying leave as a result of the coronavirus:

There are one billion dollars provided to states to expand unemployment benefits for those who have been laid off in response to strains imposed by the virus.

The bill contains a number of provisions and requirements impacting employers and employees. Certain businesses with less than 50 employees will be exempt from certain requirements if such requirements would jeopardize the businesses ability to operate on a go forward basis. The bill has tremendous implications to employers so businesses need to work closely with their human resource advisors.

If you have questions about the Families First Act, you can email familiesfirstact@ladies-wine.com

If you or your business accepted Visa or Mastercard credit cards as payment between January 1, 2004年及1月25日, 2019, 你可能有权得到...

A strong cash flow forecast that accurately predicts cash position over the desired period is mission-critical for nearly every business. 构建一个...

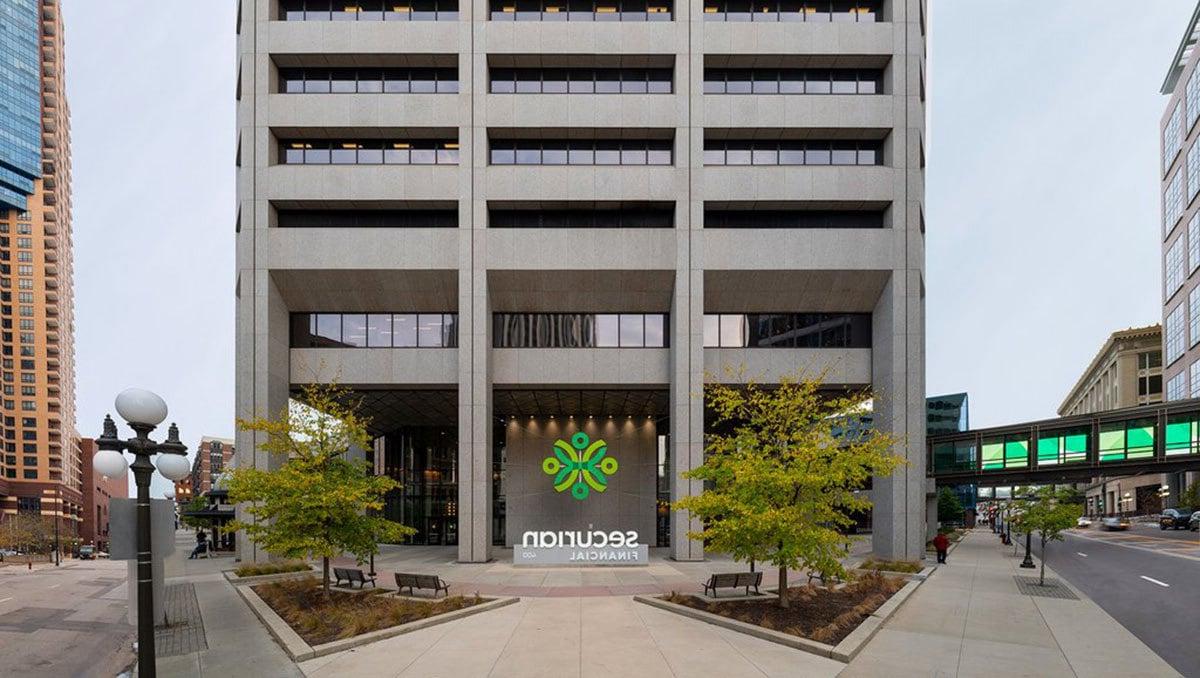

圣保罗, MN(五月八日), 2024) - In a significant stride towards modernization and a renewal of their commitment to remain headquartered in downtown...